In the ultra-competitive world of MotoGP, where fractions of a second separate glory from mediocrity, the concept of competitive balance is paramount. Following a period of unprecedented single-manufacturer dominance, the sport’s organizers introduced a radical new concession system designed to ensure the long-term health and competitiveness of the entire grid.

This dynamic, tiered system is more than just a set of rules; it is a vital mechanism aimed at preventing a one-make series, providing a lifeline to struggling factories, and ultimately, creating closer and more exciting racing for the fans. This definitive guide breaks down the philosophy behind concessions, details the four-tier system currently shaping the championship, and explains why this complex balancing act is more important than ever for the future of MotoGP.

Why Concessions Became Essential: The Threat of a One-Make Championship

To understand why the new concession system was implemented with such urgency, one only needs to look back at the 2024 MotoGP season. It was a year of almost total domination by Ducati. The Italian manufacturer, with eight bikes on the grid, created a sea of red that overwhelmed the competition. The statistics were staggering: out of 20 Grand Prix races, Ducati machinery won 19. The podium was an all-Ducati affair on 14 separate occasions. At one event, the Thailand Grand Prix, all eight of their bikes finished inside the top 10 of the sprint race. This wasn’t just success; it was a near-total lockout.

This level of dominance, while a monumental achievement for Ducati, posed an existential threat to the championship. There was a genuine and palpable fear within the paddock that historic manufacturers like Honda and Yamaha, unable to close the significant performance gap, might follow Suzuki’s recent example and withdraw from the sport altogether. Faced with the prospect of becoming a de facto Ducati cup, MotoGP’s organizers, Dorna Sports, knew they had to act decisively. The concession system was their answer—a bold intervention designed to pull the competitive elastic of the grid back together before it snapped.

The Four Tiers of Competition: A Detailed Breakdown

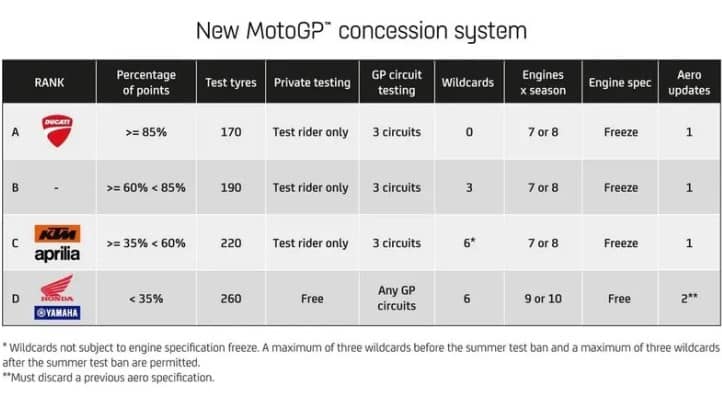

The modern concession system, introduced for the 2025 season, moves away from a simple “yes or no” model and implements a dynamic, four-tiered ranking system (A, B, C, and D). A manufacturer’s rank is determined by the percentage of the total possible constructors’ points they scored in the previous season. Each tier comes with a specific set of allowances and restrictions covering key areas of development, including engine allocations, private testing, wildcard appearances, and aerodynamic updates. Here is a detailed breakdown of each tier, using the 2025 rankings as a clear example.

Tier A (The Champions)

This tier is reserved for the dominant manufacturer that has scored over 85% of the available points. For 2025, this ranking is occupied solely by Ducati. The restrictions are severe, designed to slow their development relative to the rest of the field.

- Engines: 8 per season, with the design frozen (no in-season development).

- Wildcards: 0 allowed for the entire season.

- Testing: Private testing is permitted at only three designated circuits, and only with official test riders.

- Test Tires: 170 sets allocated for testing.

- Aero Updates: Only one aerodynamic bodywork update is permitted per season.

Tier B (The Challengers)

Tier B is for manufacturers scoring between 60% and 85% of the points. Due to Ducati’s immense dominance in 2024, this tier is empty for the 2025 season. The restrictions are slightly more relaxed than Tier A.

Tier C (The Contenders)

This tier is for manufacturers who have scored between 35% and 60% of the points. For 2025, this includes KTM and Aprilia. These are competitive factories that are winning races but have not yet achieved championship dominance.

- Engines: 8 per season, with a frozen design.

- Wildcards: 6 per season, which can be used to test development parts.

- Testing: Private testing at three designated circuits, with test riders only.

- Test Tires: 220 sets allocated for testing.

- Aero Updates: One aerodynamic update permitted per season.

*

Tier D (The Rebuilders)

This is the most crucial tier, designed as a powerful lifeline for struggling manufacturers who have scored less than 35% of the points. For 2025, this includes the Japanese giants Honda and Yamaha. The allowances are extensive, designed to fast-track their recovery.

- Engines: 10 per season, with the freedom to develop the engine design throughout the year.

- Wildcards: 6 per season, with no restrictions on engine development.

- Testing: Free private testing at any MotoGP circuit, and crucially, they can use their full-time factory race riders in these tests, not just test riders.

- Test Tires: 260 sets allocated for testing.

- Aero Updates: Two aerodynamic updates are permitted per season.

A Dynamic System: The Mid-Season Promotion and Relegation

A key feature of this new system is its dynamic nature. The rankings are not locked in for an entire year. There is a mid-season “checkpoint” that assesses manufacturer performance over the first half of the season. At this point, a manufacturer can be promoted or relegated to a different tier based on their current results.

For example, if a Tier D manufacturer performs exceptionally well, they could lose some of their concessions mid-season. Conversely, if a Tier C manufacturer struggles, they could be granted more development freedom. This mechanism ensures the system is responsive and that no manufacturer is stuck with unfair restrictions or advantages for too long, keeping the competitive balance in a constant state of adjustment.